34+ kentucky take home pay calculator

The Kentucky minimum wage is 725 per hour. Web tool Kentucky paycheck calculator Payroll Tax Salary Paycheck Calculator Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or.

Kentucky Income Tax Calculator Smartasset

Web Kentucky State Unemployment Insurance SUI As an employer youre responsible for paying state unemployment insurance which covers those unemployed.

. Determine your filing status Step 2. For example if an employee earns 1500 per week the. Net income Adjustments Adjusted gross income Step 3.

Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week. Your average tax rate is 1167 and your marginal. Well do the math for youall you.

Web Kentucky Income Tax Calculator 2022-2023 If you make 70000 a year living in Kentucky you will be taxed 11493. Web Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Figure out your filing status work out your adjusted.

Web How do I figure out how much my paycheck will be. Easy 247 Online Access. Web Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator.

Web Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Supports hourly salary income and multiple pay frequencies. Web Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Web The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the percentage of. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky. Open an Account Earn 14x the National Average.

Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. It can also be used. The unadjusted results ignore the holidays and paid vacation days.

Web Use our take home pay calculator to determine your after-tax income by entering your gross pay and additional details. Web This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. Web Use our free Kentucky paycheck calculator to determine your net pay or take-home pay by inputting your period or annual income along with the pertinent.

February 2021 Hereford World By American Hereford Association And Hereford World Issuu

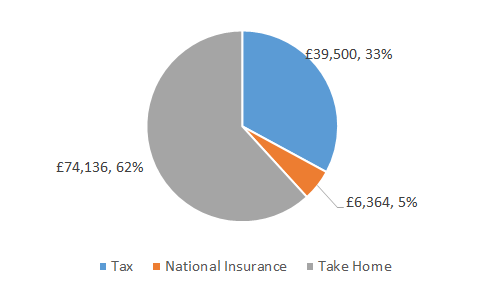

120 000 After Tax 2019

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Markets Insider

2023 Gross Hourly To Net Take Home Pay Calculator By State

Kentucky Paycheck Calculator Smartasset

33500 After Tax 33 5k Take Home Pay 2021 2022

What Is Pmi Understanding Private Mortgage Insurance And Removing It

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

96 000 After Tax 2022 2023 Income Tax Uk

Walton Ridge Apartments 73 Cami Court Walton Ky Rentcafe

The 5 Minute Clinical Consult 2019 27th Edition Pdf Sensitivity And Specificity Evidence Based Medicine

600 Flood Rd Shelbyville Ky 40065 Mls 1487590 Redfin

.png?width=850&mode=pad&bgcolor=333333&quality=80)

The Villages Of Burlington Apartments 5109 Frederick Lane Burlington Ky Rentcafe

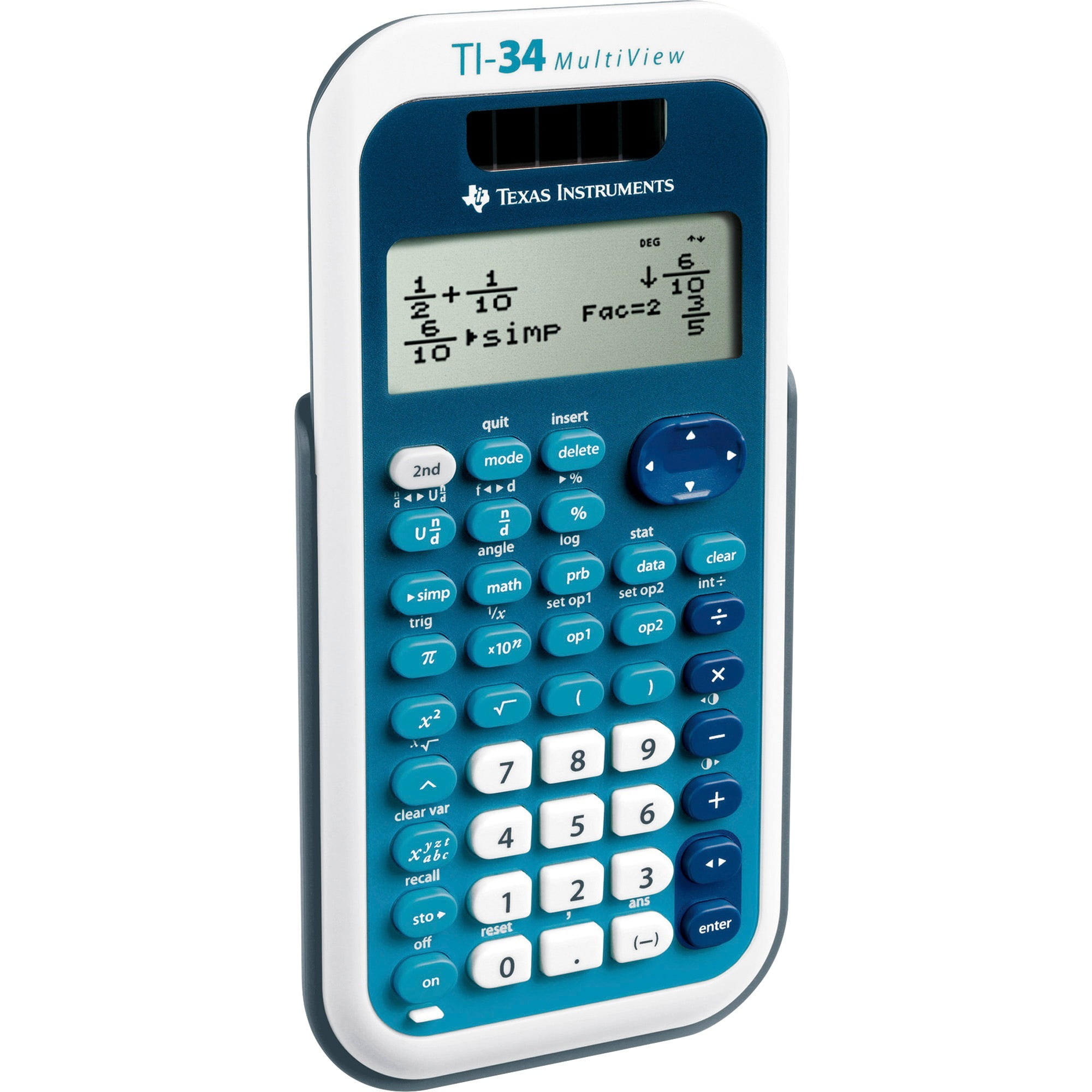

Texas Instruments Ti 34 Multiview Scientific Calculator Walmart Com

New Tax Law Take Home Pay Calculator For 75 000 Salary

600 Flood Rd Shelbyville Ky 40065 Mls 1487590 Redfin

2023 Reserve And National Guard Drill Pay 4 6 Increase